The Enduring Importance of Space Within a Virtual Border: The Hong Kong Stock Exchange’s Trading Hall

In the first eight months of 2020, as the COVID-19 pandemic spread globally from China, the Hong Kong Stock Exchange still managed to raise more than US$19 billion in initial public offerings (IPOs) of corporate stock. This sum was a remarkable return to form after the region was rocked by protests in 2019; less than 75 per cent of that amount was raised over the same period that year. These new corporate stocks now make up part of the exchange’s total value, known as its market capitalisation, which hovers above US$5 trillion. About 80 per cent of this total value is in companies tied directly to mainland China (HKEX 2020). By facilitating the trade of Chinese companies, many of which are state-owned, the Hong Kong exchange plays an important role in the market-based ownership of China’s economy. The trade of these mainland companies in Hong Kong raises new questions about China’s borders: where are they, what gets out, and what gets in?

The trading hall that houses the exchange is a single, double-height room of more than 4,000 square metres. It is located within an office complex built to house it, Exchange Square, which stands prominently within the Central District, the financial heart of Hong Kong, at the southwestern corner of De Voeux Road and Man Yiu Street. The windowless trading hall sits above the ground floor, level with Central’s robust network of elevated walkways.

Although the trading hall is accessible only by appointment, the institution is certainly not hiding. The large mass of the hall is clearly visible from the popular walkway connecting the International Financial Centre and the Central Ferry Piers with the rest of Central. On the southwestern corner of the building, at the main entrance to Exchange Square, a glass-walled lobby is wrapped by a digital marquee that scrolls through the latest stock prices. A pair of large multicolour screens bedecks each side, looping promotional ads with facts and figures about trading volumes. Along the southeastern corner of the hall, set into the building, is a covered walkway that exposes a small section of the hall, allowing people to freely walk up and peer in through a glass-walled entrance. This literal transparency into the exchange belies the aims of the modern-era exchanges’ relationship with the public: the ability to invest in an ever-expanding financialised market economy—one that yields highly unequal outcomes. It is this aspirational idea of participation—that anyone could just walk into Hong Kong’s stock exchange—that exemplifies what Cecilia L. Chu (2021) terms the ‘speculative governmentality’ of Hong Kong.

What follows is a brief account of the recent history of the Hong Kong Stock Exchange’s trading hall, examining the broad institutional changes and successive redesigns of the hall from 1986 to now. The first section is on the past iterations of the space and the political economy that informed them at the turn of the century, while the last three sections focus on the present. This short summation of the elite organisation shows how its trading hall is an integral space within the economic border of mainland China—a border crossing facilitating the movement of corporate ownership between China and global financial markets.

Into the New Millennium

Before the exchange existed in its current location, four stock exchanges operated in the Central District. The Hong Kong Government led a push to unify them, with the exchange leaders ultimately obliging and the Legislative Council passing the Stock Exchange Unification Ordinance in 1980 (Schenk 2017). The ordinance created a new enterprise named the Hong Kong Stock Exchange and bestowed it with a monopoly on all stock trading in the colony.

With the unified exchange formalised on paper, the next step was to find it a home. The government placed a prime harbourfront lot in the Central District up for bidding. Hongkong Land, a real estate company that owns much of the surrounding Central District, won the bid and built Exchange Square. While P&T, a prominent design firm based in Hong Kong, designed the wider complex, the exchange hired a smaller practice, Lu, Woo & Partners, to do the trading hall interior. The cavernous hall was squared with concentric rows of trading desks facing a prominent four-sided electric quotation board that hung from the ceiling above the open trading space below. The floor was swathed in red carpet and the walls were hung with squares of red sound-deadening fabric. In the southwestern corner, a viewing platform on the second floor allowed the public to observe the trading below. In 1986, trading officially began in the purpose-built hall, beginning the contemporary era of the Hong Kong Stock Exchange.

In the 30-plus years since, the stock exchange has assisted in the liberalisation of mainland China by aligning its corporate governance with global norms and integrating its corporations within global financial markets. As part of China’s economic reform, new stock exchanges opened in Shanghai and Shenzhen, and both were given different listings. Shanghai received the ‘red stocks’, comprising the country’s well-established corporations, and Shenzhen was given the emerging technology stocks. In her ethnography of the reform-era Shanghai exchange, Ellen Hertz (1998) argues that the government’s near total structuring of the stock market prioritised its own interests first, with elite financiers benefiting second, and the general investing public last. This sort of top-down planning created functional differentiations not only between financial markets and actors, but also between urban economies—with cities like Shenzhen exploiting their exceptional status as a driver of economic growth (O’Donnell et al. 2017). When trading began inside Exchange Square in 1986, across the border, the first master plan for the Shenzhen Special Economic Zone was also put forward, formalising the country’s material plans for increased cross-border integration with Hong Kong and its international connections.

Hong Kong was no different in this urban competition, pitching its stock market to the Chinese state as the enterprise with the proper capitalist expertise and facilities for it to use to enter global financial markets. At first, this strong market culture and unified technological infrastructure significantly contributed to Hong Kong’s attraction of Chinese investment through what are called B corporations—companies traded and incorporated in Hong Kong but which maintained their true operations in southern China. Then, beginning in 1993, a new financial product called H-Shares brought further integration by placing ownership of companies from mainland China directly on to the Hong Kong Stock Exchange. These IPOs allowed China’s state companies to sell stocks outside the mainland for the first time, theoretically offering nearly half of their ownership to capitalists around the world. The exchange has since hosted countless IPOs for China’s state-owned enterprises.

The rise of global financial capital brought newer technological pressures to the physical space of the exchange. Beginning with the new fibreoptic and satellite networks introduced in the Exchange Square hall, it seemed possible that the need for a physical space to house the market might eventually be unnecessary. The Automatic Order Matching and Execution System was introduced in 1993, and updated again in 1996 and 2000, further facilitating the process of wholly digital trading. This process of automating the market was a long one, moving through a complex history of technology that laid the social infrastructure for today’s amorphous markets (Pardo-Guerra 2020). With this smoothing of financial transactions came a new spatial relationship with the exchange; more trading began to take place offsite, especially on new digital trading floors inside the offices of investment banks and brokerage houses. As the number of traders on the floor of the hall dwindled, remodelling was required to befit an increasingly digital exchange.

As the stock exchange neared the new millennium, under pressure from the region’s financial secretary, it merged with Hong Kong’s futures exchange and three clearing houses under a new parent company named Hong Kong Exchanges and Clearing Limited (HKEX). In 2000, HKEX listed on its subsidiary company, the Hong Kong Stock Exchange (HKSE). This act of listing the exchange on the exchange itself is known as demutualisation; many other stock exchanges demutualised in the same period (Akhtar 2002). This transformed the HKSE from a member-owned non-profit into a publicly traded for-profit company. This restructuring hypercharged the exchange’s self-interest in its corporate identity.

The first major renovation of the hall came in 2006, with the opening of the renamed Exchange Trading and Exhibition Hall Complex. The global design firm Aedas won the commission to redesign the interior. From a singular trading floor, the hall was divided for multiple functions. The trading floor now occupied less than half of the space. The trading desks were arranged in a circle for 300 traders and their staff. According to the design lead of the project, Dmytriy Pereklita (2017), the renovation ‘transformed the previously isolated facility into a welcoming boulevard that allows visitors an unobstructed view of the elliptical trading floor on one side, and access to the new exhibition & interactive educational media spaces on the other’. The space also included media booths that television stations could hire for broadcasting—scenes of the trading floor adding to a newscast’s authority. The renovation took six months and cost HK$50 million (Yiu and Kwok 2006).

The redesign provided extensive space for manifestations of the history and cultural aspects of the market. These spaces had a larger footprint than the trading floor itself. A new auditorium seating 180 people, for example, sought to create social cohesion by hosting communal lectures and conferences, while elsewhere visual displays narrated the exchange’s history, and a souvenir shop catered to visitors.

Connect Hall

The most recent version of the hall has done away with the physical trading floor altogether, and the exchange hall is now primarily a space of congregation for the city’s financial industry, and trading takes place digitally offsite. Yet even without a physical space for trading, the hall continues to play the same transborder role between China and the global financial system. Most notably, the Stock Connect program facilitates stock trading between Hong Kong’s exchange and the mainland exchanges in Shenzhen and Shanghai. Paradoxically, while new technologies allowed traders to work even when physically apart, the social functions of the trading hall grew. These functions have built on past forms of celebration and spectacle that aimed to solidify trust and goodwill among market investors and the broader public.

In 2014, ‘the last time the exchange disclosed such statistics, trading at the hall made up a negligible 0.2 per cent of total turnover on the city’s bourse’ (Yiu 2017). Three years later, the trading hall was shuttered to allow the removal of the trading floor altogether. In-person trading in an established trading hall ceased nearly a century and a half after trading practices began in Hong Kong, and more than a century after traders first professionalised and moved indoors. The closure of the entire trading hall allowed for a three-month renovation, which transformed the space into the Hong Kong Connect Hall. As well as the new space, the exchange also released a new logo, graphic identity, and a strategic vision of ‘connecting China with the world’ (HKEX 2016).

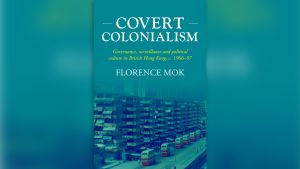

This most recent iteration of the hall serves predominantly as a space for events related to stocks and finance, and for corporate receptions and conferences on various socioeconomic issues popular among elites. Such spaces have become the international norm in recent years, serving as symbolic centres of a stock market rather than as the material spaces of trading. The ‘connect’ in the new placename refers to the Stock Connect program, as well as the Bond Connect, a trading program with the China Interbank Bond Market that opened in 2017. These programs exemplify the Hong Kong Stock Exchange’s strategic vision to act as a mediator between China and the world. From the nineteenth century to the present day, spaces for stock trading have played a part in facilitating the transferral of power from Hong Kong as a paradigm of British imperialism to an emergent neoliberal China.

At the Connect Hall opening in 2018, Hong Kong’s Chief Executive Carrie Lam explained: ‘The Connect Hall has a double meaning, connecting all parties in the market while it also refers to the stock connect schemes between Hong Kong and the mainland’ (Yiu 2018). The hall’s current form increases its ability to function as a gathering point for the territory’s financial community. The space is open for hire, with prices topping around US$32,000 for a full day. This attracts key people from widely diverse economic sectors. We can see this play out through the Connect Hall’s location tag on Instagram, where people post photos of their awards ceremonies for business students, charity auctions, and entrepreneurship, and corporate governance conferences. According to HKEX (2018), the new hall is ‘designed for maximum flexibility, capable of simultaneously hosting multiple events’. Within the hall as well are expanded media booths for broadcasting directly from the exchange. All of these functions within the exchange hall allow the exchange to reach local, national, and global audiences.

Constant Improvement and Renewal

In the new Connect Hall, roughly one-quarter of the renovated area is devoted to an exhibition space called the Museum of Finance in Hong Kong. The space displays photographs and objects from the exchange’s past alongside a sweeping financial history of China. The exhibition is curated by China’s Museum of Finance, a quasi–nongovernmental organisation with close ties to the Chinese state that curates and operates nine museums of finance, banking, and money across the People’s Republic of China, in close partnership with local governments and the Beijing administration.

The exhibition focuses most of its attention on the financial history of China. Notable is the history of currency, which takes up a large swathe of the space. Money, as an everyday object of material culture, is a popular subject for public audiences, yet currency’s prominent inclusion in the stock exchange exhibition has multiple purposes. It stretches the museum’s content beyond the corporate economy of the stock market and confuses it with the far-reaching economy of currency. It acts to present the notion of an unfettered stock market as integral to the economy of main street and not, as the left asserts, the financial economy.

Shortly after Connect Hall’s inauguration, local papers covered a curatorial snafu found in the new exhibition. At the exhibition entrance, a large, curved wall displays the many iterations created from the Chinese root word for money, which originates from the word for shell coins. Some of the characters featured referred to wealth and winning, but some also held negative connotations about theft and bribery. Critics across social media picked up on the unflattering choice of words and, soon after the grand opening, the exchange covered up many of them (Cheng 2018). The incident revealed the exchange’s present power as an institution, the influence of the mainland, and how the market space is perceived differently among mainland officials, the Hong Kong public, and elite financiers.

In an effort to smooth over this faux pas, a spokesperson for the exchange told a reporter: ‘The construction of the exhibition centre is a systemic work that requires constant improvement and renewal’ (Cheng 2018). Few phrases sum up the exchange’s history better than this. This dialectic of constant change is reminiscent of what Amy Thomas (2012), in a seminal article on the London Stock Exchange, framed as the essential paradox of a trading hall: a trading hall houses the stock market, yet that market is also embedded within a vast material geography of the corporations traded therein. It is in the exchange’s own attempted consolation of this paradox, its constant improvement and renewal of the space to better fit the times, that the paradox of its existence becomes most evident.

Opening Ceremonies

In response to COVID-19, the Hong Kong Stock Exchange created a virtual format of its gong-ringing ceremony that marks the moment when a company is newly listed for trade on the exchange. The first such ceremony took place three days after an attendee of a traditional listing ceremony tested positive for the virus. The plans for a virtual ceremony had, however, been in the works for some time, with companies from mainland China having already taken their pre-listing ‘roadshows’—a sales pitch to investors—online around the world. The typical pre–COVID-19 ceremony took place at the exchange hall in Central, where the strike of the gong marked the opening of the day’s trading, and was preceded by a brief reception, press photoshoot, as well as speeches by executives of the listing company and representatives from the exchange.

The hall of the stock exchange is one staging of the stock market. In everyday life, the stock market is more often presented through news media across television, newspapers, and online (Clark et al. 2004). Talking heads and the stock ticker make up much of the public’s perception of the market. Is it up? Or down? But it is in the physical premises of the exchange, inside the new Connect Hall, that it is able most directly shape perceptions of the market, especially through the IPO ceremonies, with triumphant speeches and champagne toasts.

The growing importance of the exchange’s symbolic presence is best illustrated by these gong-striking ceremonies. The exchange began these ceremonies some eight years ago as part of a new series of services that included other forms of promotion to ‘help listed companies gain additional visibility among investors’ and therefore ‘to assist listed companies seeking efficient and cost-effective access to capital’ (HKEX 2012). After becoming an entirely trader-less venue, the exchange acquired a new, larger gong. This new gong was inaugurated the same year the Connect Hall opened and is reportedly 80 per cent larger than its predecessor, weighing 200 kilograms, and costing US$45,000 (Shenshen 2018); it was first used for the listing of Xiaomi, one of China’s largest tech companies. The gong and renovated hall parallel a fundamental change taking place in many exchanges around the world: as trading goes virtual, the symbolic importance of the exchange hall has grown. The larger gong photographs better, increasing the drama of the action of striking it, therefore amplifying the intended symbolism of a company’s listing, monumentalising the practice to gigantean proportions.

While the digital gong is less dramatic, taking the gong online is important to the Hong Kong exchange because of its cherished status as the global exchange capable of raising the most capital through IPOs. This top ranking is owed wholly to its relationship to corporations from mainland China—a relationship and status it aggressively seeks to maintain as the mainland’s own exchanges in Shanghai and Shenzhen grow in both capability and global investor confidence. Through the Hong Kong Stock Exchange’s online and animated gong of the COVID-19 era, we can hear the performance of integration that would normally be seen within the exchange hall. Given Hong Kong’s increased integration and still rising importance within the mainland’s economy, we will likely see ever-more spectacular spatial and aesthetic performances like this—new forms of identity construction that seek to shore up the Hong Kong Stock Exchange as an important border crossing between China and the world.

References:

Akhtar, Shamshad. 2002. Demutualization of Stock Exchanges: Problems, Solutions and Case Studies. Manila: Asian Development Bank.

Cheng, Kris. 2018. ‘Hong Kong Stock Exchange Covers Up Chinese Characters for “Bribe”, “Thief”, “Greed” on Newly-Designed Wall.’ Hong Kong Free Press, 28 February. hongkongfp.com/2018/02/28/hong-kong-stock-exchange-covers-chinese-characters-bribe-thief-greed-newly-designed-wall.

Chu, Cecilia L. 2021. Colonial Urban Development in Hong Kong: Speculative Housing and Segregation in the City. London: Routledge.

Clark, Gordon L., Nigel Thrift, and Adam Tickell. 2004. ‘Performing Finance: The Industry, the Media and its Image.’ Review of International Political Economy 11(2): 289–310.

Hertz, Ellen. 1998. The Trading Crowd: An Ethnography of the Shanghai Stock Market. Cambridge, UK: Cambridge University Press.

Hong Kong Exchanges and Clearing Limited (HKEX). 2012. ‘HKEX Launches Issuer Services.’ Exchange, 29 January.

Hong Kong Exchanges and Clearing Limited (HKEX). 2016. ‘HKEX Strategic Plan 2016–2018.’ Hong Kong: HKEX, 1.

Hong Kong Exchanges and Clearing Limited (HKEX). 2018. ‘HKEX Connect Hall Fact Sheet.’ 20 February. Hong Kong: HKEX, 1. www.hkex.com.hk/-/media/HKEX-Market/News/News-Release/2018/170220news/1802202news.pdf?la=en.

Hong Kong Exchanges and Clearing Limited (HKEX). 2020. ‘HKEX Monthly Market Highlights.’ Consolidated Reports, August. Hong Kong: HKEX. www.hkex.com.hk/Market-Data/Statistics/Consolidated-Reports/HKEX-Monthly-Market-Highlights?sc_lang=en&select={6EA87B6C-938A-48B1-8CDA-6960712E4C54}.

O’Donnell, Mary Ann, Winnie Wong, and Jonathan Bach. 2017. Learning from Shenzhen: China’s Post-Mao Experiment from Special Zone to Model City. Chicago, IL: University of Chicago Press.

Pardo-Guerra, Juan Pablo. 2020. Automating Finance: Infrastructures, Engineers and the Making of Electronic Markets. Cambridge, UK: Cambridge University Press.

Pereklita, Dmytriy. 2017. ‘Hong Kong Stock Exchange.’ Dkstudio website. www.dkstudio.ca/hong-kong-projects.

Schenk, Catherine R. 2017. ‘Negotiating Positive Non-Interventionism: Regulating Hong Kong’s Finance Companies, 1976–86.’ China Quarterly 230: 348–70.

Shenshen, Zhu. 2018. ‘Sounding the Gongs for Hong Kong Stock Debuts.’ Shine, 23 July. www.shine.cn/biz/economy/1807239155/.

Thomas, Amy. 2012. ‘“Mart of the World”: An Architectural and Geographical History of the London Stock Exchange.’ Journal of Architecture 17(6): 816–55.

Yiu, Enoch. 2017. ‘Electronic Dealing Marks the End of an Era, as Hong Kong’s Iconic Trading Hall to Close in October.’ South China Morning Post, 15 August, 1.

Yiu, Enoch. 2018. ‘Hong Kong Bourse Operator Unveils Multifunctional HKEX Connect Hall at Site of Trading Hall.’ South China Morning Post, 20 February. www.scmp.com/business/companies/article/2133901/hang-seng-index-makes-red-debut-first-year-dog-trading-day.

Yiu, Enoch and Ben Kwok. 2006. ‘Circular Trading Hall a Wonderful Fit in Exchange Square.’ South China Morning Post, 17 January, 14